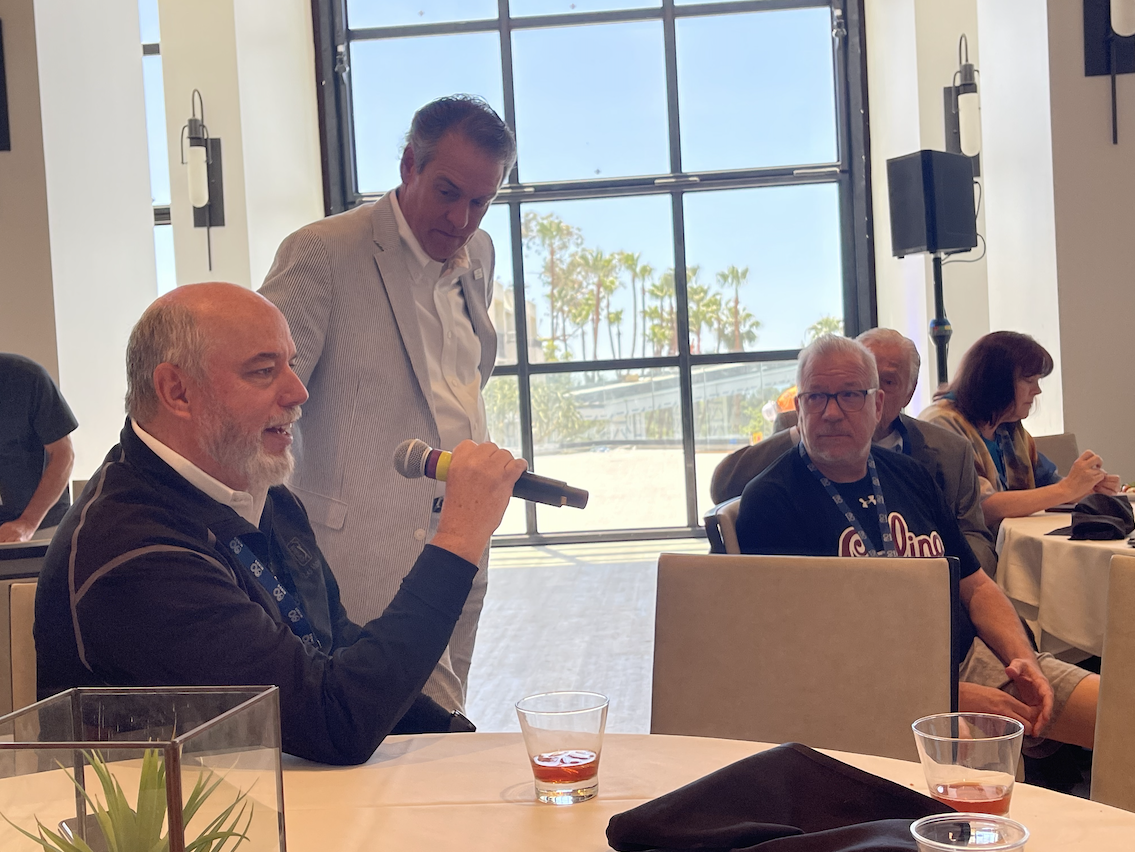

Ed and Ron were honored to have Kevin Smoot on the show, who Ron met at various accounting conferences. After the first time Kevin heard Ron speak, he went back to his firm and completely transformed his business model. We dove into the details of this transformation, Kevin’s current strategy, and future plans.

A bit more about Kevin Smoot…

Since preparing his first tax returns as a senior in high school, Kevin has dedicated his entire professional career to assisting and educating clients on how to become better stewards of their finances. He has worked for CPA firms in the DC area and has extensive experience in the preparation of both personal and corporate tax returns along with identifying the unique tax deductions associated with each of these entities and their relationship to the owners. Kevin has a love for art, mainly photography, and finds it intriguing to look at things from multiple points of view. He uses this method when looking at tax returns to implement strategies to achieve the optimal results for his clients. Kevin has been interviewed on a number of podcasts such as Ben Haggerty’s Black With No Cream and YouTube channels with Kai Andrew. He has also been featured on platforms such as Practice Ignition and continues to serve as an advisor to Intuit and QuickBooks on software development. Kevin’s Designations: Enrolled Agent, Certified Concierge Accountant, Certified Tax Coach, Registered Investment Advisor, QuickBooks ProAdvisor

Use these show notes to follow along with the audio…

Segment one:

Kevin prepared his first tax returns in high school! He took an accounting class in high school, fell in love with it, and dove right in with some help from his cousin who owned a firm. It was a 1040EZ but Kevin was in HIGH SCHOOL!

Kevin likes puzzles and he likes numbers. He would iron all of his money from chores at a young age. He knew he was “an organizer of money” (his words…..GREAT words).

Once college hit, Kevin didn’t have any questions. He wanted to be an accounting major. After that he wanted to jump into his own business but needed experience and went to work at a tax firm.

Around 25 years old, Kevin quit his job and went out on his own. Then a recession hit and he learned a lot about business beyond simply having ambition. So he went back to CPA firms until about 4 years ago when he struck out on his own again.

When hiring, Kevin prefers someone who is able to nurture the customer relationship and also has an accounting background. He admits, it’s an odd combination but works really well.

Check out the brief onboarding questionnaire on Kevin’s website. It’s on the homepage and at the top. Really well done and it’s only 4 questions. https://www.accountability-inc.com/

Segment two:

What made Kevin select the EA designation instead of the CPA designation? He knew he wanted to focus on tax from he very beginning. It’s a bit of a non-traditional route but Kevin knew he wanted to be very specific in his focus.

What is Kevin’s why? He is focused on employees and the clients. For employees, it’s all about work/life balance with unlimited PTO. For clients, it’s about using tax to build and preserve wealth.

In 2016, Kevin saw Ron speak for the first time. It was mostly about value pricing but — even back then — Ron touched on subscription pricing during the talk.

Before the 2016 talk from Ron, Kevin’s “pricing was terrible” (his words, not mine!). He knew this and began to study the resources available to help him improve. He started with The Pumpkin Plan by Mike Michalowicz!

“The consumer’s not an idiot. She’s your wife.” —Ron Baker

Segment three:

What does the value conversation look like for Kevin? His clients want more than just a transaction. He’s done a lot to focus on the broader relationship.

Kevin’s client interview is a bit different than most. He knows who he is going to work with in the first 30 seconds. Your personality needs to be a good fit. “One of us has to laugh in the first 30 seconds or it’s not going to be a good fit.” —Kevin Smoot

Have you considered joining us at Patreon.com/TSOE for access to bonus shows and commercial free shows? Now sponsored by @90Minds! Need a mind? Find one at 90Minds.com

Does Kevin have a minimum price? Yes. He could really like you but the relationship needs to be equitable for all involved and that includes a minimum price.

What does the value conversation look like in years 2 and 3 as a client, for example, goes from 10 rental properties to hundreds of properties? Most clients now it’s coming. It’s not a surprise.

Real estate and service based entrepreneurs are what Kevin’s organization has niched down to recently. https://www.accountability-inc.com/

Segment four:

How long did the subscription transformation take for Kevin’s firm? Each year he takes about 1/5th of the firm and helps transform the relationship.

At RateThisPodcast.com/TSOE, you can — Yep! — Rate. This. Podcast. We read all reviews on the air. Good, bad, or indifferent.

Kevin’s firm is virtual so how does he view KPIs since there is no time tracking? It’s straightforward, he looks at margins and general turnaround time of assigned projects.

The shift to subscription pricing has done two important things for Kevin: 1) He’s just much happier now and 2) He has been able to hire 5 teammates since making the shift.

A big THANK YOU to Kevin Smoot for joining us today and talking about his journey to subscription pricing. Real estate and service based entrepreneurs are his thing! Find out more at https://www.accountability-inc.com/

Bonus Content is Available As Well

Did you know that each week after our live show, Ron and Ed take to the microphone for a bonus show? Typically, this bonus show is an extension of the live show topic (sometimes even with the same guest) and a few other pieces of news, current events, or things that have caught our attention.

This past week was bonus episode 404 - Roomba and furniture ads

Here are a few links Ron and Ed discussed on the bonus episode:

Tesla Model Y to Become Best-Selling Car in the World | HYPEBEAST

What takes years and costs $20K? A San Francisco trash can | AP News

States Expand Sales-Tax Holidays as Americans Feel Price Increases - WSJ

American Airlines is purchasing 20 of Boom's supersonic Overture Jets

Why Japan is trying to get young people to drink more alcohol - VICE

Click the “FANATIC” image to learn more about pricing and member benefits.