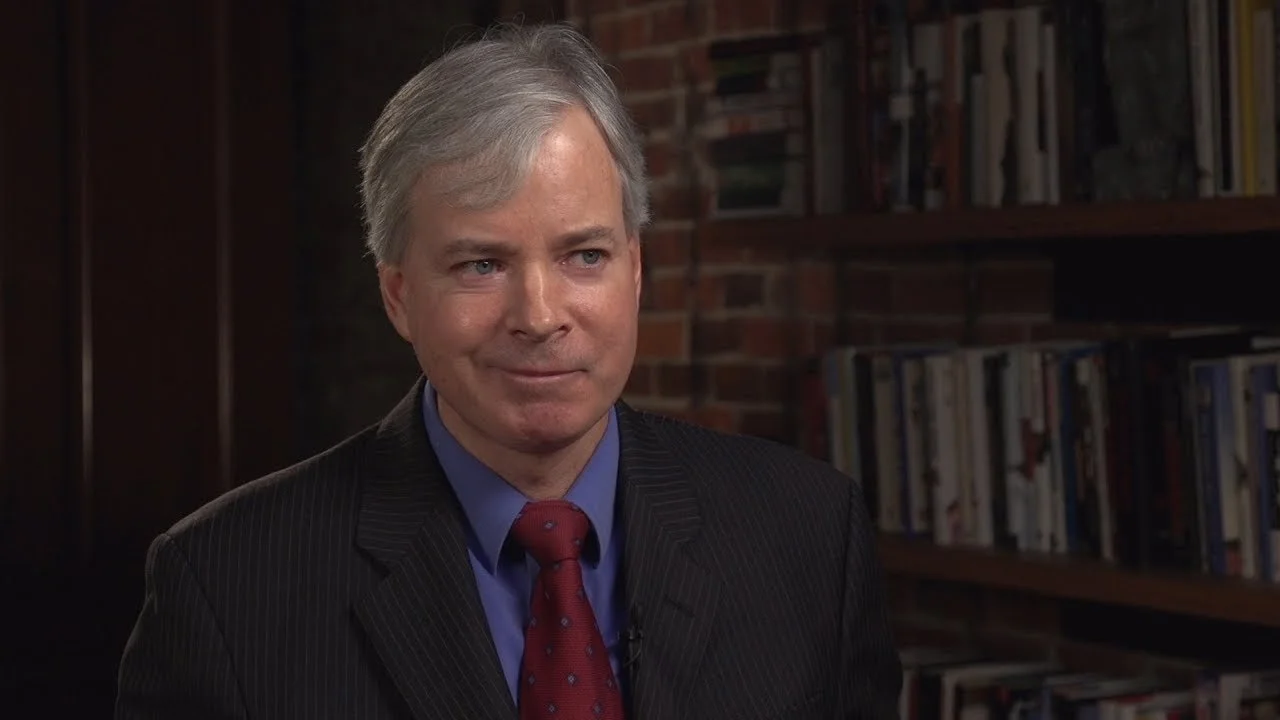

Back in January with spoke with Chris Edwards about how wealth fuels economic growth. We welcome Chris back to talk about his other area of expertise - US tax policy. Join us on "Tax Day" (well sort of, it was extended to April 18 this year), for what will be a lively and wide ranging conversation about this topic that effects everyone.

Before we get to the show notes, here is a bit more about Chris Edwards:

Chris Edwards is the director of tax policy studies at Cato and editor of www.DownsizingGovernment.org. He is a top expert on federal and state tax and budget issues. Before joining Cato, Edwards was a senior economist on the congressional Joint Economic Committee, a manager with PricewaterhouseCoopers, and an economist with the Tax Foundation. Edwards has testified to Congress on fiscal issues many times, and his articles on tax and budget policies have appeared in the Washington Post, Wall Street Journal, and other major newspapers. He is the author of Downsizing the Federal Government and coauthor of Global Tax Revolution. Edwards holds a B.A. and M.A. in economics, and he was a member of the Fiscal Future Commission of the National Academy of Sciences.

Here are the show notes. Use these to follow along while listening to the show:

Chris recently wrote “Exploring Wealth Inequality” which counters Thomas Pickety and his erroneous data. Link here: https://www.cato.org/sites/cato.org/files/2020-01/pa-881-updated-2.pdf

We don’t have good information on wealth and wealth distribution in the US. The idea of wealth inequality is not easy to get to without official data. For example, tax returns only cover about 60% of income earned in the United States.

In the US, you can become wealthy in the market because it is so dynamic. 70% of the Forbes top 400 are self made. In other countries, cronyism is more prevalent and it is easier for families to retain wealth over generations.

The OECD for two decades have been increasingly pushing for global level tax rules. This is currently the “global 15% tax” that you might have heard about. Here are Chris’ thoughts on the Cato site: https://www.cato.org/blog/g-7-corporate-tax-agreement

On the show today, Chris Edwards remarked that “it’s a win-win when you cut tax rates” to which Ed invoked the Laffer curve. Well done! https://www.investopedia.com/terms/l/laffercurve.asp

Our Patreon channel, at Patreon.com/TSOE, is sponsored by some of our Patrons. For example, we would love to give a shoutout to Blake Oliver of EarmarkCPE.com. Earn CPE credits for listening to podcasts just like this one!

Is it true that the IRS only audits the poor? The EITC and other refundable credits have a long history of error and fraud rates. This rates have been as high as 25-30%. It’s a massive spending program in the tax code with high fraud rates.

“Tying up financial accounting to the government’s tax accounting is a really bad idea.” Here are some deeper thoughts from Chris: https://www.cato.org/blog/democratic-tax-plan-would-corrupt-financial-statements

The optimal tax gap is not zero. This would mean IRS agents knocking on everyone’s door and intrusion into every laptop in the US. This is not on balance with our expected civil liberties. Around 3-6% of GDP is the level for the US with 6-10% in the EU.

Every nation has a tax gap which creates the “shadow economy”. These are activities outside of the government’s scope. The US has a much smaller shadow economy compared to other free countries.

60-90% of IRS audits are incorrect. If that number shocks you, it shouldn’t. Chris has quite a few more figures in his article “Simplify Tax Code to Solve IRS Mess” https://www.cato.org/blog/simplify-tax-code-solve-irs-mess

Bonus episodes and commercial free episodes are available at our Patreon channel, Patreon.com/TSOE, which is sponsored by @90Minds. Need a mind? Hire one at 90Minds.com

Should the government offer a pro forma tax return instead of citizens figuring it out? Not exactly. Chris believes in a simplified tax code instead of a pro forma return.

Every employee pays a 15% income tax to the federal government. It’s not half from the employee and half from the company. The employee is “fully burdened” which should be obvious to anyone paying attention.

“We don’t need the government inventing new taxes and putting a wet blanket on new technologies.” —Chris Edwards

“We know the wealth tax is a horrible idea because even the giant welfare states in Europe have gotten rid of them.” —Chris Edwards

Chris mentioned “civil liberties” related to IRS tax enforcement several times today on the show. What exactly does he mean? Fortunately, he wrote a full article on it at this link https://www.cato.org/blog/irs-tax-enforcement-vs-civil-liberties

Interesting fact from today’s chat with Chris Edwards: Did you know that some high income western counties do not tax capital gains at all?

The Government Accountability Office and the taxpayer advocates group recently discovered that the IRS is only answering about 15% of phone calls from confused American taxpayers.

A big THANK YOU to Chris Edwards for joining us today. Beyond his lengthy bio he is also the editor of DownsizingGovernment.org

Bonus Content is Available As Well

Did you know that each week after our live show, Ron and Ed take to the microphone for a bonus show? Typically, this bonus show is an extension of the live show topic (sometimes even with the same guest) and a few other pieces of news, current events, or things that have caught our attention.

Click the “FANATIC” image to learn more about pricing and member benefits.