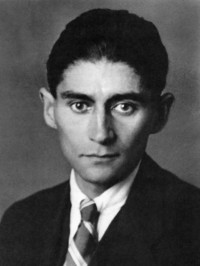

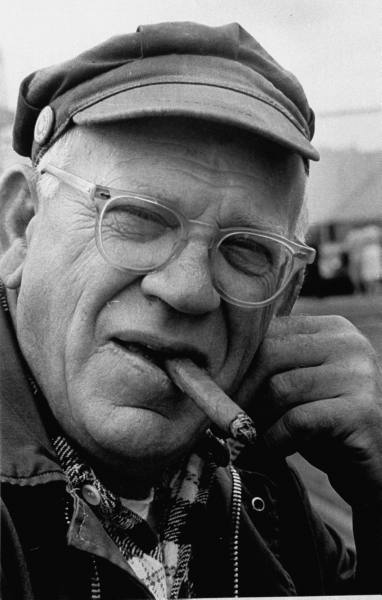

On the show this week, we had a discussion about Richard Feynman and why he is a memorable mentor. Here’s some background to get you started…

Biography

According to Wikipedia, Richard Feynman [May 11, 1918 – February 15, 1988] was an American theoretical physicist, known for his work in the path integral formulation of quantum mechanics, the theory of quantum electrodynamics, and the physics of the superfluidity of supercooled liquid helium, as well as in particle physics for which he proposed the parton model. For his contributions to the development of quantum electrodynamics, Feynman, jointly with Julian Schwinger and Shin'ichirō Tomonaga, received the Nobel Prize in Physics in 1965. In a 1999 poll of 130 leading physicists worldwide by the British journal Physics World he was ranked as one of the ten greatest physicists of all time. He assisted in the development of the atomic bomb during World War II and became known to a wide public in the 1980s as a member of the Rogers Commission, the panel that investigated the Space Shuttle Challenger disaster.

So Many Quotes

Some people are just “quotable”…that is, their words lend themselves either purposefully or naturally to being easily quoted. Richard Feynman is most certainly one of these individuals. The following quotes were excerpted from the book, The Pleasure of Finding Thing Out: The Best Short Works of Richard P. Feynman, published in 1999 by Richard’s family.

In physics, unlike chess, when you discover new things, it looks more simple.”

“The kick in the discovery,” the sudden feeling grasped a wonderful new idea, that there was something new in the world.”

He did physics for the fun of it—for the pleasure of finding out how the world works. When he received the pre-dawn call informing him he won Nobel prize, he replied: “You could have told me that in the morning.”

He won the Nobel prize for work he did in 1947, at the age of 29.

“Why knowing merely the name of something is the same as not knowing anything about it.”

“Social science is not a science—it’s a pseudoscience [Hayek called it scientism].

“I’d rather have questions I can’t answer than answers I can’t question”

“The question of doubt and uncertainty is what is necessary to begin; for if you already know the answer there is no need to gather any evidence about it.”

“The question is not whether it’s true or false, but rather how likely it is to be true or false.”

“Without doubt there is no progress, no learning.”

“And there’s no learning without posing a question, and a question requires doubt. People search for certainty, but there is no certainty.”

Don’t know a problem: ignorant

Have a hunch: uncertain

Pretty sure of result: some doubt

“The English call it “muddling through”, it’s the most scientific way of progressing—one must leave the door to the unknown ajar.”

“The power of government should be limited; that governments ought not to be empowered to decide the validity of scientific theories, that that is a ridiculous thing for them to try to do.”

“A friend of mine, Albert R. Hibbs suggested very wild idea: it would be interesting in surgery if you could swallow the surgeon.”

On the Challenger disaster: [we should not] “encourage ordinary citizens to fly in such a dangerous machine, as if it had attained the safety of an ordinary airliner. For a successful technology, reality must take precedence over public relations, for nature cannot be fooled.”

“Learn from science that you must doubt the experts. As a matter of fact, I can also define science another way: Science is the belief in the ignorance of experts.”

“I’ve learned how to live without knowing. I think my life is fuller because I realize that I don’t know what I’m doing. I’m delighted with the width of the world!”

In a chapter titled the “Relation of Science and Religion,” he writes: “I do not believe that science can disprove the existence of God; I think that is impossible. Moral questions are outside the scientific realm.”

Science is the belief in the ignorance of experts.

Hell, if I could explain it to the average person, it wouldn't have been worth the Nobel prize.

Adjectival sciences, aren’t. - Attributed.

Some additional quotes…not necessarily from the same book as referenced above:

There are 1011 stars in the galaxy. That used to be a huge number. But it's only a hundred billion. It's less than the national deficit! We used to call them astronomical numbers. Now we should call them economical numbers.

The real problem in speech is not precise language. The problem is clear language. The desire is to have the idea clearly communicated to the other person. It is only necessary to be precise when there is some doubt as to the meaning of a phrase, and then the precision should be put in the place where the doubt exists. It is really quite impossible to say anything with absolute precision, unless that thing is so abstracted from the real world as to not represent any real thing.

No government has the right to decide on the truth of scientific principles, nor to prescribe in any way the character of the questions investigated. Neither may a government determine the aesthetic value of artistic creations, nor limit the forms of literary or artistic expression. Nor should it pronounce on the validity of economic, historic, religious, or philosophical doctrines. Instead it has a duty to its citizens to maintain the freedom, to let those citizens contribute to the further adventure and the development of the human race.

The real question of government versus private enterprise is argued on too philosophical and abstract a basis. Theoretically, planning may be good. But nobody has ever figured out the cause of government stupidity — and until they do (and find the cure), all ideal plans will fall into quicksand.

Do you seriously entertain the idea that without the observer there is no reality? Which observer? Any observer? Is a fly an observer? Is a star an observer? Was there no reality in the universe before 109 B.C. when life began? Or are you the observer? Then there is no reality to the world after you are dead? I know a number of otherwise respectable physicists who have bought life insurance.

If we suppress all discussion, all criticism, proclaiming "This is the answer, my friends; man is saved!" we will doom humanity for a long time to the chains of authority, confined to the limits of our present imagination. It has been done so many times before.

Related to and of Feynman

We didn’t spend the entire show reading Richard Feynman quotes (although we did find a Twitter account that effectively does that). There were a few other topics worth calling out during our discussion this past week.

Richard Feynman discussed the Cargo Cult Science in this 1974 Caltech Commencement Address.

Who doesn’t like a good TED video? They have a BBC clip with Feynman: https://www.ted.com/talks/richard_feynman

Try to say hexaflexagon five times fast. Don’t know what that is? Ed can help! Here is a trilogy of videos about Vihart's Hexaflexagon:

Can’t get enough? Yeah, we love geometry too. Here is some more on Flexagons: https://en.wikipedia.org/wiki/Flexagon