This episode is dedicated to the possibility that quality is not objective goodness but rather conformance to a requirement.

Episode #185: Free-Rider Friday - March 2018

Ed’s Topics

Tweet from Keith

Alchemy Financial (@WeLivetoServe), asking us to discuss Bitcoin. You have to report your sales of Bitcoin on your tax returns, but how do you deal with the “forks”—are they dividends, etc.?

@edkless @ronaldbaker been a while since you discussed, request to talk $BTC today on @asktsoe? #AskTSOE

— We Live to Serve (@WeLivetoServe) March 30, 2018

Also, the HyperLedger, hyperledger.org, a project being run by the Linux Foundation, a who’s who of leading companies.

Ron brought up “The crypto sun sets in the East,” from The Economist, Jan 20, 2018. While Japan has embraced bitcoin, China has banned it, and South Korea is in the middle.

Though South Korea is less than 2% of global GDP, it has nearly 15% of Bitcoin-trading, yet South Koreans pay a 40% premium for bitcoins, due to capital controls.

Bitcoin is supposed to be freedom from government, yet in Asia, it is governments that are making or breaking their fortunes.

Amazon and Berkshire Hathaway Innovating Healthcare

Two articles: Capx.co article by Tim Warsaw on Amazon teaming up with Amazon and Berkshire Hathaway on healthcare.

HealthcareIT news: 5 different areas where Amazon could disrupt healthcare:

Durable medical equipment and supplies

Mail order and retail pharmacy

Pharmacy benefit management

Telemedicine and in-home healthcare using Echo and Alexa

AI-powered diagnostics for continuing care

Facebook Knows Your Politics

Shout-out to listener Hector Garcia.

Go to your Facebook settings > Ads > Your Information > Your Categories > US politics.

Five categories: Very Liberal, Liberal, Moderate, Very Conservative, and Conservative. You can delete them if you want.

Stephen Hawking, R.I.P.

Barry Brownstein on Stephen Hawking's Final Warning: Why His Worries Were Unwarranted

Steel and Aluminum Tariffs

In response to the charge that the Chinese government was subsidizing its steel producers an economist said, "Number one, it’s very dubious that it’s true, but suppose it were true. Then that would be a foolish thing for the Chinese to do from their own point of view, but why should we object to them giving us foreign aid? We’ve given them quite a bit."

Actually it is Milton Friedman and it was about the Japanese government forty years ago. Why won't this myth die!

Robin Corner, FEE, Toxic Masculinity article

Autonomous Vehicle Update

“Regulators Are Asleep at the Wheel on Self-Driving Cars,” Bloomberg, March 26, 2018, Brad Stone

Tragic death of a pedestrian, cutting in front of a car, she was at fault. Will this slow down progress?

“Driverless cars given green light to operate in California,” Financial Times, February 27, 2018

On Monday, Feb 26, 2018 California’s Department of Motor Vehicles green light to manufacturers and tech companies to test and deploy autonomous vehicles without a “natural person” inside the car. Also, no steering wheel or pedals required. The car must have a “remote operator.” Arizona, Michigan, Nevada also allow this type of testing. Safety campaigners say this could turn California’s roads into a potentially lethal video game. What are they now?

50 companies are testing in CA, including Alphabet, Uber, Apple, GM, Ford, Toyota. DMV could start issuing permits for locals to take rides by April 2nd. “Disengagement reports” must be submitted every year: measuring how many times a human had to step in, and each car must have a “black box.” Waymo’s score on Disengagement: once every 5,596 miles, and General Motors: once every 1,254 miles.

Ron’s Topics

“Firm direction,” The Economist, March 3, 2018

McKinsey has been compared the US Marines, the Jesuits and the Freemasons. It consults with 90 of the Forbes top 100 firms, even helping Britain leave the EU, and the Saudis wean themselves off oil.

Kevin Sneader, Scottish Chairman replaces Dominic Barton as managing partner (2,000 partners).

Half of what it does today are capabilities that did not exist 5 years ago (it would be interesting to know how much revenue is earned from those capabilites?)

It is recruiting more data scientists and software developers, but staying relevant with technology firms is proving difficult. Unicorns, Facebook, Google, and Amazon don’t use McKinsey’s services, somewhat because McKinsey helps cut costs, and that’s not an issue in these companies.

Also, these companies compete with McKinsey in recruiting talent.

The former managing partner, Dominic Barton, also oversaw the shift towards a results-based fee model, in line with Boston Consulting Group, Bain and [Accenture].

Russia Ruins Aviation Record

Saratov (SA-RA-TIV) Airlines flight 6W703 crashed soon after takeoff, killing all 71 on board. It’s the first fatal crash since November 2016. There were no deaths in 2017.

I still can’t afford to move to Texas, Ed

“So Many People Are Fleeing the San Francisco Bay Area, It’s Hard to Find a U-Haul,” FEE, Mark J. Perry, February 14, 2018. The San Francisco Bay Area is #1 for out-migration: Sacramento, Austin, Portland, OR. Reason: high cost of housing (even high skilled). A San Jose U-Haul operator’s biggest problem: getting his vans back! Nationwide, cities with biggest inflows, according to Redfin: Phoenix, Las Vegas, Atlanta, and Nashville.

Cost of Renting a U-Haul from San Jose to Las Vegas is $1,990 Las Vegas to San Jose $121.

“AI vs. Lawyers,” LawGeex

Another shout-out to listener Hector Garcia. AI achieves 94% accuracy rate identifying and highlighting 30 proposed legal issues in five standard non-disclosure agreements. Human lawyers averaged 85% accuracy. It took the humans anywhere from 51 minutes to more than 2.5 hours to complete all five NDAs, while the AI engine finished in 26 seconds.

Ethical Question: does the Algorithm round up and charge the full hour?

“A tale of two Washingtons,” The Economist, March 10, 2018

Amazon’s second headquarters got bid from 240 cities/regions. It’s culled down the list to 20, including Toronto. Amazon says it will employ 50,000, and invest $5 billion over 15 years.

Three out of the 20 finalists are in the Washington, DC area: the city itself, northern Virginia, and Montgomery County, Maryland. Jeff Bezos already owns a home in D.C., and the Washington Post.

Amazon Web Services (AWS) already has a home in Herndon, VA, 10 minutes from Washington Dulles airport (second in Amazon employees). AWS has prominent government clients, including the CIA, and the government spend approximately 5% of the $1.6 trillion spent on technology each year.

Regulatory threat has increased as Amazon moves into financial, home security, logistics, healthcare, etc. It has already beefed up its lobbying, and having 50,000 employees and their children attending the same country clubs and schools as government officials is a shrewd strategy.

Also, having two headquarters makes a split from AWS and Amazon Retail much easier, if the company is ever divided due to antitrust laws.

“We Need Bullies: Chris Rock Speaks Truth to Weakness in Tamborine,” National Review, February 15, 2018, Kyle Smith

Who said it?: G.K. Chesterton, John Wayne, Jordan Peterson?

“We need bullies. Pressure makes diamonds. Not hugs. Hug a piece of coal and see what you get. You get a dirty shirt.”

“That’s why there’s so many fat kids in school right now—because there’s nobody to take their lunch money.”

Chris Rock, on his new Netflix special Tamborine.

“Hollywood’s New Matinee Idol: Karl Marx,” Kyle Smith, National Review, February 22, 2018

Haitian filmmaker Raoul Peck has done The Young Karl Marx. August Diehl as Marx and Stefan Konarske as Engels.

“A crashing dud.” 5.9/10 on Rotten Tomatoes

Critics Consensus: The Young Karl Marx makes a valiant attempt to make the philosophical cinematic, but lacks sufficient depth to tackle its complex themes. No one wants to watch a movie about a nerd scratching away at his desk. Marx did fight power: he was forced out of three countries.

The trailer shows him visiting a factory with a child labor: but Marx never set foot in a factory.

“He may have dreamed up a party, but he wasn’t exactly the life of it.”

“Quoting Marx puts audience in a state of enjoyment approximating winter in Leningrad.”

“Engels, a limousine liberal before limousines.”

Few will walk away with deeper understanding of Marxism or communism, sort of like reading his work.

March iTunes Reviews

Thank you to everyone who has submitted a review, it means the world to us. To review us on iTunes, visit - https://itunes.apple.com/us/podcast/soul-enterprise-business-in/id893874169?mt=2

Modern Sales Training 5-Stars by mlubbe78 March 11, 2018

This podcast has been a great way to continue to drip the ideas and methods of value pricing into my daily work habits. I run an eCommerce software agency, and my business partner, our Sales Director, and I share our sales and business development workload. Many episodes of this podcast have been shared between the 3 of us as we continue to work hard to develop our skills as pricers within the value prcing model. We’re about 3 years in and getting better with every customer interaction. I also appreciate the Free-Rider Friday segments. They’re a refreshing break from the deep value concepts, and also provide some excellent annecdotes from the present. Keep it up guys. Great stuff.

Great content, entertaining delivery 5-Stars by Tlm WM March 13, 2018

These guys have great practical insight, refreshing they do it with humility, humor and practical experience. I even applied to my own business because what and how they explained was easy to digest. Great podcast.

Taking Down Trickle Down/and MANY others 5-Stars by Greg Lafollette, March 19, 2018

This review is way (WAY) past due. In the interest of full disclosure I must first tell you that Ron & Ed are both long time friends of mine. So there’s that. But—friendship aside, I will tell you that I consume a LOT of information via podcasts and my subscriptions often outstrip my available time to listen. When that happens, something has to give. Here’s the essence of my review: when something has to give, it is never, NEVER, TSOE. I may get behind a week or two occasionally but I always listen to every episode. These guys are smart, witty, have amazing domain knowledge, and are genuinely interested in improving the human condition—well, at least the professional services part of the human condition. Whether it’s emerging technology, value creation, pricing, the (dreaded) billable hour, or some fascinating tangent the show is always entertaining and enlightening. [NOTE: Except when Ed talks baseball—then it’s lights out for the rest of that episode!] Keep up the great work gentlemen. You are deeply appreciated. gll

Episode #184: Interview with Professor Thomas Hazlett

Thomas Hazlett holds the H.H. Macaulay Endowed Chair in Economics at Clemson, conducting research in the field of Law and Economics and specializing in the Information Economy, including the analysis of markets and regulation in telecommunications, media, and the Internet.

He served as Chief Economist of the Federal Communications Commission, and has held faculty positions at the University of California, Davis, Columbia University, the Wharton School, and George Mason University School of Law. His research has appeared in such academic publications as the Journal of Law & Economics, the Journal of Legal Studies, the Journal of Financial Economics and the Rand Journal of Economics, and he has published articles in the Univ. of Pennsylvania Law Review, the Yale Journal on Regulation, the Columbia Law Review, and the Berkeley Technology Law Journal.

He has provided expert testimony to federal and state courts, regulatory agencies, committees of Congress, foreign governments, and international organizations. His latest book, The Political Spectrum: The Tumultuous Liberation of Wireless Technology, from Herbert Hoover to the Smartphone, was published in 2017, and The Fallacy of Net Neutrality, published in 2011.

Professor Hazlett also serves as Director of the Information Economy Project at Clemson University. His book, Public Policy Toward Cable Television, was co-authored with Matthew L. Spitzer (MIT Press, 1997), and He also writes for popular periodicals including the Wall Street Journal, New York Times, Reason, The New Republic, The Economist, Slate, and the Financial Times, where he was a columnist on technology policy issues, 2002-2011.

Ron’s Questions

Your Wikipedia says you were a child actor:

He was born in Los Angeles and grew up in the San Fernando Valley. In his youth, he attended Los Angeles city schools and worked as a child actor, appearing in TV shows such as McHale's Navy, The Monkees, and Land of the Giants, movies such as Walt Disney's "Follow Me Boys," and commercials for Wonder Bread and the Ford Torino. Having studied dance, he auditioned to join the traveling Bolshoi Ballet in Hollywood in 1962, but was rejected and ultimately studied economics instead.”

In your latest book is The Political Spectrum: The Tumultuous Liberation of Wireless Technology, from Herbert Hoover to the Smartphone, published in 2017, you write, "No natural resource more critical to 21st century than radio spectrum." Why?

You cite Cooper’s Law: wireless traffic doubles roughly every 2 years. We enjoy one trillion times the wireless capacity of networks than a century ago. Did I read that right?

How can the spectrum be “scarce”—and thus we need government regulation—if it has grown one trillion times?

You call it “The Wise Man Theory of Regulation”—the idea that the FCC can know “the public interest.” The price mechanism is very capable of allocating a scarce resource, we do it all the time. It’s superior to a centrally planned economy, as the USSR and other socialist failures have taught us. I love this line from the book, "It’s not the physics of radio waves but the economics of public choice [that help you understand this allocation process]."

The Political Spectrum chronicles the delays imposed on the market by the FCC from Cable TV, Satellite TV & Radio, FM radio, and cellular telephones. I’ll just ask you about one of those. Would you tell the story of Edwin Howard Armstrong, born in 1890?

One of the greatest inventors of the 20th century, largest shareholder in RCA for his patents on AM radio. He invented FM radio in 1933.

FCC doubted it would work; incumbents argued against it.

Finally, the FCC allows it in 1941, with 67 FM stations in operation.

In 1954: Armstrong commits suicide.

In 1960 FM rises from the dead; by 1979 FM listeners outnumber AM listeners.

Is it fair to say that if net neutrality rules were in place in 2007, Apple could not have marketed the iPhone?

Switching to television, spoiler alert: I LMAO at this story in your book. You write about the most famous speech EVER given by an American regulator, in Las Vegas, on May 9, 1961 by FCC Chairman Newton Norman Minow [the “vast wasteland” speech” that equated broadcasters with drug dealers. The passive-aggressive response from TV broadcasters was in the 1964 debut on CBS of the TV show “Gilligan’s Island,” which mockingly named the stranded boat the S.S. Minnow].

You discuss how in 1961 Cox Cable offered 12 channels in San Diego for $5.50 per month, but the FCC delayed Cable TV competition for years. The FCC even squashed the Dumont Network in 1955, which had “The Honeymooners.”

Cellular technology was introduced in July 1945 but the FCC didn’t allocate spectrum until 1982, and granting licenses in 1989. You estimated the delay of licensing cost consumers $100 billion.

As you say, perverse regulatory consequences mean never having to say you’re sorry!

Ed’s Questions

How is your NCAA Bracket doing?

Regarding net neutrality: whenever both sides talk about this, a frequent metaphor is the road system or package delivery service. Do you think those are good metaphors, why or why not?

Whenever net neutrality emerges, I always get two images in my mind: two tennis players on different courts trying to playing each other, and both sides seem to talk past each other, not using the same language, etc., would you address that for a bit?

Is it too far fetched to say that the composition of the FCC is economically nearly as important as the Supreme Court?

Your former colleague, economist Bryan Caplan has coined the term “the political Turing test”: a challenge for you to argue for or against something making the best case for your opponents so they think you agree with them. What is your best argument in favor of net neutrality?

Have you seen any early positive or negative effects from the repeal of net neutrality?

Episode #183: Interview with Peter Block

In Flawless Consulting, Peter Block talks about three different types of consultants: pair of hands, expert, and collaborators. All three have their challenges as there is no sweet spot.

Episode #182: How to Have a Value Conversation

Why is it so hard to have the value conversation? Two reasons: 1) Professionals are solutionists (Mahan Khalsa's great word), i.e., they jump to the solution, which is the antithesis of the value conversation; and 2) Professionals are afraid there is “no value,” what they offer is a “commodity.”

Yet holding a value conversation shouldn’t be difficult since both sides want to maximize value!

Ron confesses his early mistake in 1989: I did pricing in a vacuum. I didn’t have a value conversation. I fell in the trap explained by Karl Albrecht, "The longer you’ve been in business, the greater the probability you do not really understand what’s going on in the minds of your customers."

Resources

Ed’s blog post: “Without the Conversation, There is no Value Pricing.”

Ed’s presentation in South Africa on the value conversation.

Mahan Khalsa’s Book: Let’s Get Real or Let’s Not Play

Backward Bicycle Video

The four steps to move off the solution

Listen

Assuage

Move

Close

The Five Golden Questions—Getting to Value

First, recognize a “measurable” word:

Revenue

Cost

Customer Satisfaction

Quality

Performance

Productivity

Et al.

Second, ask Mahan Khalsa’s Five Golden Questions

How do you measure it?

What is it now?

What do you want it to be?

What is the value of the difference?

Over time (usually one year)?

The Art of Questioning

Language was invented to ask questions. Answers may be given by grunts and gestures, but questions must be spoken. Humanness came of age when man asked the first question.

Social stagnation results not from a lack of answers but from the absence of the impulse to ask questions.

––Eric Hoffer, Reflections on the Human Condition

Naïve listening

Calvin Coolidge, said to be one of the country’s most laconic Presidents. When his successor as Governor of Massachusetts met him in the White House he is said to have asked the President how it was that he sometimes stays in the Governor’s office until 11:00 p.m. working and meeting with his designated appointments.

Yet, his aides inform him that when Coolidge was Governor he used to leave the office each day no later than 5:00 p.m. The successor asked Coolidge, “What’s the difference?” Coolidge responded: “You talk back.”

Listening is hard since we think faster than people talk. Talkers may dominate a conversation, but listeners control it.

Our favorite opening for the value conversation: Mr. or Mrs. Customer, we will only undertake this engagement if we can agree, to our mutual satisfaction, that the value we are creating is at least three (to ten) times the price we are charging you. Is that acceptable?

Sample Summary of Findings Report

Episode #181: Taking Down "Trickle Down"

Linguistics

Words and terminology change, we accept that fact. And indeed, even some proponents of supply-side economics describe it—positively—as “trickle down.” Even Rush Limbaugh does.

But the label doesn’t explain how economy works. Thomas Sowell once wrote something to the effect that it can take 23 pages to refute a bumper sticker, and that’s how we feel about this topic. It’s complicated, with a rich history that goes far beyond the “trickle down” moniker.

What is Supply-Side Economics?

Supply-side economics is perhaps one of the most misunderstood, and mischaracterized, theories in recent times. In reality, it’s quite simple, and very logical. Basically, capitalism is propelled by supply, not demand. Each actor in the economy has a dual purpose—that is, of producer and consumer. Which comes first?

People don’t consume in order to produce, they produce in order to consume. You don’t write a book because you acquire a computer; rather, you acquire a computer in order to write a book. Everyone knows, however, that their ability to consume, on the whole, is no greater than their ability to supply. In real terms, then, demand is supply.

Any buyer of a book, automobile, haircut or stereo pays not in the currency of demand—i.e., money—but from his own provision of goods and services to others..

When you obtain a haircut, you are simply trading some of your services as a CPA for those of a barber. Money is simply a convenience; it takes away the need for a “coincidence of wants” necessary in a barter economy. Money allows the trade to commence, even though your barber may not need CPA services at the time of your haircut.

By focusing on money—that is, demand—we miss the real essence of what makes an economy work. The very idea of people as consumers is deceptive and patronizing, as people must supply first in order to demand later.

This is the reason supply-side models are unconcerned with spending and demand. Rather, they focus on the producer by removing obstacles to production and trade. Economist Jean Baptise Say coined Say’s Law of Markets: Supply of X creates demand for Y.

In other words, a society’s income can never exceed its output.

In this case, supply of lemonade creates demand for electronics.

If you’d like more information on supply-side economics, as well as the logic and history behind it, Ed and I have found the following books most helpful. We’ll provide some of the main point from each below.

“Trickle Down” Theory and “Tax Cuts for the Rich”, Thomas Sowell, 2012

“No such theory has been found in even the most voluminous and learned histories of economic theories…”

In a syndicated column Sowell challenged anyone to name any economist who advocated a “trickle down” theory. Lots named someone who claimed someone else advocated it.

It’s a classic case of arguing against a caricature instead of confronting the argument actually made, very similar to the Strategic Defense Initiative vs. Star Wars.

President Franklin Roosevelt’s speech writer, Samuel Rosenman referred to:

“The philosophy that had prevailed in Washington since 1921, that the object of government was to provide prosperity for those who lived and worked at the top of the economic pyramid, in the belief that prosperity would trickle down to the bottom of the heap and benefit all.”

Much same argument was made by William Jennings Bryan’s famous “cross of gold” speech in 1896.

Economist John Kenneth Galbraith labeled supply-side economics by using “the-horse-and-sparrow” metaphor: The horse is fed oats, some will pass through to the road for the sparrows.

President Woodrow Wilson in a 1919 message to Congress actually understood the negative consequences of high tax rates:

The Congress might well consider whether the higher rates of income and profits taxes can in peace time be effectively productive of revenue, and whether they may not, on the contrary, be destructive of business activity…

There is a point at which in peace time high rates of income and profits taxes discourage energy, remove the incentive to new enterprise, encourage extravagant expenditures, and produce industrial stagnation with consequent unemployment and other attendant evils.

The idea that profits “trickle down” to workers depicts the actual economic sequence in the opposite order. In reality workers are hired and paid first, before any output, or indeed, profits.

The real effect of tax rate reductions: they make future prospects more favorable, leading to more current investments, more economic activity, more risk-taking, entrepreneurship, and jobs.

Econoclasts: The Rebels Who Sparked the Supply-Side Revolution and Restored American Prosperity, Brian Domitrovic, 2009

This is the first scholarly history of the supply-side movement based on primary sources.

The movement was enhanced by a bunch of renegade, mavericks, all under 40, such as Jude Wanniski (author of the fantastic book, The Way The World Works), George Gilder, Robert Bartley editor of the Wall Street Journal, Congressman Jack Kemp and his staffer Paul Craig Roberts, who did have a PhD in economics.

There were two academic economists: Art Laffer and Robert Mundell, the latter a Nobel Prize winner in 1999). Five other Nobel economists were also associated with Supply-Side economics: Robert Lucas, Edward Prescott; the pioneer in “public choice” theory, James Buchanan; and Milton Friedman.

Robert Mundell elaborated on tax cuts and stable money in 1971 at a talk in Italy. His Nobel address is a great statement of supply-side economics and its historical vision.

Mundell has a university in China named after him: Mundell International University of Entrepreneurship.

No one called it “supply-side economics” in the 1970s. Jude Wanniski referred to it as “The Mundell-Laffer Hypothesis.”

Herbert Stein, economist and father of Ben Stein (of Ferris Bueller’s Day Off fame) labeled the movement “Supply-Side fiscalists,” a term of mild derision. Wanniski liked it, and used supply-side economics instead.

In December 1974, at the Two Continents restaurant in Washington, D.C. Arthur Laffer drew his now famous curve on a cocktail napkin. Present were: Jude Wanniski, Donald Rumsfeld (President Ford’s Chief of Staff), and his deputy, Richard Cheney.

Paul Krugman in an article in the New York Times, “The Tax Cut Con,” Sept 14, 2003: “Supply-side economics was a political doctrine from Day 1; it emerged in the pages of political magazines, not professional economic journals.”

This is untrue. From Day one it emerged on the pages of the IMF Staff Papers. And with Mundell’s presentation of a paper in 1958 to a Stanford faculty seminar, including the editors of the American Economic Review.

The Laffer curve is nothing more than a common sense view of taxation that comports to reality—that is, there are two rates that will bring zero revenue to the government: 0% and 100%. The crucial rate, to the supply sider, is the marginal rate, not the effective rate—the rate that applies on the last dollar earned, since it affects the decision to invest.

If you subscribe to the logic that 0% and 100% will generate the same level of revenue, that logically leads you to conclude that the power to tax is, indeed, the power to destroy. Thus, every human undertaking, short of breathing, can be destroyed by taxation.

Britain, in the 1970s, had a top marginal rate of 98% on investment income. At a time when England was in economic decline, there were many Rolls Royces on London’s streets. This was mistaken as a sign of prosperity, when in fact it was a sign of confiscatory tax rates on investment income. It simply made more sense to consume than invest.

There are basically two effects from reductions in marginal tax rates (as opposed to tax revenues):

Income Effect—people have more money, so they work less (a target income theory).

Substitution Effect—work pays more relative to leisure, so people work more.

The argument is over which effect dominates. If it were true that people worked harder, in order to achieve a “target level” of income—even at tax rates approaching 90%--then we should tax the poor and lower-to-middle income workers at these rates in order to encourage them to work more.

This is nonsensical and is not consistent with human behavior—the way to get people to work harder is to raise their taxes! One wonders what workers would do if employers proposed the same work at reduced wages? Once you understand that additional effort often requires increasing rewards, then you have the basic logic behind supply-side economics.

This could explain why Americans work more than Europeans?

Unbelievably, this same argument is used for savings—that is, people have a “target level” of savings they want to achieve, and by lowering the tax rate they will achieve it faster, and therefore consume the excess. This also does not comport to human behavior.

Andrew W. Mellon, Taxation: The People’s Business, 1924

Incomes over $300,000

Year Rate Taxes paid at progressive rate Returns filed

1916 7% $81,404,194 1,296

1921 77% $84,797,344 246

In 1921, over 80% of those earning over $300,000 disappeared!

There were 206 millionaires in 1916; tax rates rose, then there were 21 in 1921! After rates dropped, they climbed back to 207 by 1925.

How did the rich avoid tax? Tax-exempt bonds, etc. Congress enacts the high tax rates, then creates the loopholes that allow the wealthy to avoid those high rates. Why?

So they can engage in class warfare rhetoric for votes, and continue to receive Donations from the wealthy.

Wealth and Poverty, George Gilder, 1981

The source of the gifts of capitalism is the supply side of the economy.

Even Marx knew enough not to stress control over the means of consumption! (or even the supply of money).

Every economy has unlimited demand, but there is no demand for new or unknown goods.

Say’s Law (supply creates demand) was not only refuted, it was implicitly reversed, with cause and effect hopelessly confused in the proposition that demand creates its own supply—“take and you will be given unto.”

Buying power does not essentially “trickle down” as wages or “flow up” and away as profits and savings. It originates with productive work at any level. Give and you will be given unto.

Consumption doesn’t need encouragement; production does:

“Even in the short run real aggregate demand is an effect of production, not of government policy. The only way tax policy can reliably influence real incomes is by changing the incentives of suppliers. By altering the pattern of rewards to favor work over leisure, investment over consumption, the sources of production over the sumps of wealth, taxable over untaxable activity, government can directly and powerfully foster the expansion of real demand and income. This is the supply-side mandate.”

Say’s Law and the Keynesian Revolution: How Macroeconomic Theory Lost its Way, Steven Kates, 1998

Kates is the Chief Economist at the Australian Chamber of Commerce and Industry.

John Maynard Keynes tried to refute Say’s Law, but misunderstood and misrepresented it.

Say’s Law: the proposition that failure of effective demand does not cause recession. Your demand power is determined by your supply power. Production is the cause of consumption, not its consequence.

Kates writes that even Sowell failed to understand the core meaning of Say’s Law in his book, Say’s Law: An Historical Analysis, 1972.

Say’s Law declared that demand would never fall short of properly proportioned supply.

Ron equates this using this example: Children are demand-side economists, while parents are supply-siders.

Jean-Baptise Say: “It is the aim of good government to stimulate production, of bad government to encourage consumption.”

Say was the French Adam Smith who coined the term entrepreneur (undertaker), loosely translated as “adventurer.”

Other Resources

John F. Kennedy’s address to the Economic Club of New York on December 14, 1962

Comedian Tim Hawkins: The Government Can

Ben Stein in Ferris Bueller’s Day Off, boring his students in economics

Episode #180: Free-rider Friday - February 2018

Ron’s Topics

The Human Freedom Index, 2017, CATO Institute, FRASER Institute

United States slips to #17. Why?

“The Upchuck wagon,” The Economist, Feb 3, 2018

23% of those survey say they will never ride in an autonomous car.

Nausea afflicts 5-10% of the population. Another issue for Uber and Lyft. Luckily a patent has been filed on a technology that claims to solve motion sickness.

Passing of Fidel Castro, Jr.

Jay Nordlinger wrote Children of Monsters, which Ron recommends.

In late Jauary, Fidel Jr. (“Fidelito”—Little Fidel), 68, killed himself—he battled depression most of his life—as reported by Cuba’s state media.

He was never close to power. Fidel Castro had 10 or 15 kids, no one really knows.

Fidel Jr. studied nuclear physics in USSR, married a Russian woman, resulting in several children. In 1980 he took aa job at Cuba’s Atomic Energy Commission. In 1992, Fidel fired him, accusing him of mismanagement and incompetence.

In 2000, he was rehabilitated and worked for the Cuban Academy of Sciences, traveling around the world as a “science advisor.”

SpaceX

The government doesn’t insure cargo that goes into space. On January 7, cargo code named Zuma was launched on SpaceX’s Falcon 9 rockets.

The cargo was a $3 billion Northrop Grumman satellite, which is classified so there’s no detailed information.

It didn’t blow up on launch, like two others, but the satellite it was caring failed to maintain orbit, believed to have ended up in the Indian Ocean.

When the Pentagon was asked about the failure it referred to SpaceX, and when SpaceX was asked, spokesperson replied: “Falcon 9 did everything correctly on Sunday night.”

Is there a moral hazard here, knowing taxpayers will suffer any losses? Would insurance make sense?

At the least, taxpayers should be made aware of details.

And, from historian Victor David Hanson, “Will train overpasses become California’s Stonehenge?”

“Life on the edge,” The Economist, January 20, 2018

There’s a big shift taking place in the tech industry: Computing is moving from the cloud back to the “edge” of local networks and intelligent devices.

Who will colonize the edge (IOT), etc? Devices on the edge are becoming more powerful.

For example, a self-driving cars produces 25 gigabytes per hour, 30 times more than a HD video stream. By time data is uploaded and instructions sent back, the pedestrian has been hit.

Last May, Microsoft changed slogan from “Mobile first, cloud first” to “Intelligent cloud and intelligent edge.”

Amazon Web Services (AWS) service Greengas, turns clusters of IOT devices into mini-clouds.

Supporting this view is an interview in Forbes with George Gilder: “Why Technology Prophet George Gilder Predicts Big Tech’s Disruption,” Rich Karlgaard, Forbes, February 9, 2018.

We highly recommend you read this interview, and watch for Gilder’s latest book, Life After Google: The Fall of Big Data and the Rise of the Blockchain Economy, due out July 16.

At some point, we will have Gilder back on to discuss these issues, and more.

Ed’s Topics

Gender gap in pay is about being a parent NOT discrimination. A few articles:

The Gender Pay Gap Is The Result Of Being A Parent, Not Discrimination

Gender pay gap in modeling industry sees women earn 75% more than men

Ron recommends reading the economic literature on this topic, which is overwhelming that the gap doesn’t have much, if anything, to do with discrimination. It’s more personal choices and biological. One book: Why Mean Earn More: The Startling Truth Behind the Pay Gap—and What Women Can Do About It.

Ed takes his first flight in a Boeing 787 Dreamliner

It was nice, but not significantly noticeable.

Dave Chapelle understands international free trade better than Donald Trump

Great line: “I want to wear Nikes not make them.” Video is NSFW!

From the Competitive Enterprise Institute, Richard Morrison on the Food Pyramid, did it make us fat?

Logan Albright, Children don’t need protecting from being confused

Personally, I do my best thinking when I am confused because it requires that I focus.

Episode #179: The Value Guarantee

Many firms think it counterintuitive to offer incentives for their customers to complain, worrying they would be inundated with angry customers; or if they did not respond effectively, they might lose the customer. These fears are unwarranted, however. The advantages of offering a value guarantee are many. It demonstrates to customers that your firm is serious about customer service and providing an exceptional experience for them. It puts your money where your mouth is. It is one thing for a firm to tell customers how good they are, quite another to show them with a value guarantee. It gives your entire organization the impetus to exceed the customer’s expectations, since now your money is on the line. This focuses the firm on the only true profit center it has: a customer’s check that does not bounce. But there’s even a bigger reason to offer a value guarantee, which Ed and Ron disclosed on the show.

The Value Guarantee

The original language is from Christopher Hart via David Maister's book True Professionalism:

Our work is guaranteed to the complete satisfaction of the client. If the client is not completely satisfied with our services, we will, at the client’s option either waive professional fees, or accept a portion of those fees that reflects the clients level of satisfaction.

Ed and Ron suggest the following modifications to bring it more into alignment with the concepts of the VeraSage Institute.

Our work is guaranteed to the complete delight of the customer. If you are not completely delighted with the work performed by us, we will, at the option of XYZ Company, either refund the price or accept a portion of said price that reflects XYZ’s level of value received. Upon payment of each of your scheduled payments, we will judge you have been satisfied.

Many firms think it counterintuitive to offer incentives for their customers to complain, worrying they would be inundated with angry customers; or if they did not respond effectively, they might lose the customer. These fears are unwarranted, however.

The late marketing professor Theodore Levitt made this observation with respect to asking for customer complaints: “One of the surest signs of a bad or declining relationship with a customer is the absence of complaints. Nobody is ever that satisfied, especially not over an extended period of time. The customer is either not being candid or not being contacted.”

Christopher W.L. Hart’s enlightening book Extraordinary Guarantees: Achieving Breakthrough Gains in Quality and Customer Satisfaction asks a very valid question: Why force people to pay for things that, in the end, they don’t value? He documents the case of the Bugs Burger Bug Killer Company (based in Miami, Florida and run by Al Burger), a pest control company specializing in the hospitality industry.

Al knew most customers did not want to control pests, but to wipe them out, so he developed an extraordinary guarantee to ensure his customers he could do the job:

You don’t owe one penny until all pests on your premises have been totally eradicated. If a guest spots a pest on your premises, BBBK will pay for the guest’s meal or room, send a letter of apology, and pay for a future meal or stay.

If you are ever dissatisfied with BBBK’s service, you will receive a full refund of the company’s services plus fees for another exterminator of your choice for the next year.

If your facility is closed down due to the presence of roaches or rodents, BBBK will pay any fines, as well as any lost profits, plus $5,000.

Would you pay a premium for the services of BBBK, given the above guarantee?

The Advantages of Offering a Value Guarantee

According to the U.S. Office of Consumer Affairs, 37 to 45 percent of all service customers are dissatisfied with some aspect of the service they receive, but do not complain. This risk of customer defection can be ameliorated by offering a money-back value guarantee.

The advantages of this policy are many. It demonstrates to customers that your firm is serious about customer service and providing an exceptional experience for them.

It puts your money where your mouth is. It is one thing for a firm to tell customers how good they are, quite another to show them with a value guarantee. It gives your entire organization the impetus to exceed the customer’s expectations, since now your money is on the line. This focuses the firm on the only true profit center it has: a customer’s check that does not bounce.

The value guarantee establishes a competitive differentiation and helps to sway the marginal customer to select your firm (especially important in Request for Proposal [RFP] work). Because having a guarantee requires a higher level of trust, the firm will do a more diligent job of prequalifying all of its new customers and will document the expectations of each party much more thoroughly.

A service with a guarantee is more valuable in the marketplace than a service without a guarantee—because it dramatically decreases the customer’s risk—and this alone enables the firm to command a premium price over its competition (think of FedEx, Nordstrom, Disney, Amazon, and BBBK). Experience shows firms can command a 15-25% price premium over their strongest competitor if they offer a guarantee.

It provides word-of-mouth advertising for your firm, because customers appreciate this policy and will be more enthusiastic about referring new customers.

It provides the customer an incentive to complain, which as we have learned, is more valuable than the alternative, because it gives the firm an opportunity to fix the service defect, preventing the same mistake being made with another customer. It is a constant trial—with the customer as judge and jury—and forces the firm to update and improve system delivery processes.

With all of that said, there is even a more substantial reason you should offer a service guarantee to all of your customers: You already do. If any of your customers were to complain loudly enough, you would make adjustments to their account, according to their wishes. Or, you would ask the customer to pay only what he or she thinks is fair. Unfortunately, this is done after the fact, when you will receive no benefit from it.

In effect, you have a covert value guarantee; I suggest you make it overt in order to gain a marketing and competitive advantage over your competition—one that you trumpet in the marketplace.

Fred Smith, when he started FedEx, painted it on the side of his airplanes and delivery trucks: “Absolutely. Positively. Overnight.” If FedEx doesn’t deliver you don’t pay—an excuseless culture.

The best source for developing a value guarantee is the front-line team members who have the most interaction with the customer. They understand where the breakdowns, inconsistencies, reworks, mistakes, and variations occur in the service delivery chain. They also understand what is possible to deliver, and can formulate a value guarantee they will have ownership and pride in.

Will some customers take advantage of a guarantee policy? Probably. But consider Nordstrom, legendary for taking back merchandise not even purchased from its stores. It estimates that 2 to 3 percent of its customers take advantage of this policy, yet 97 to 98 percent appreciate the policy and are more loyal—and pay a premium price—as a result.

Do not let the tail wag the dog. If any one customer were to abuse your service guarantee, he would actually be doing you a favor by self-identifying himself as a problem customer. Gladly refund his money and fire that person from your firm.

Please do not misconstrue anything I have said here as meaning “The customer is always right.” That is patent nonsense. Even e-Satisfy.com has shown through its research that up to 40 percent of expressed dissatisfaction is caused by the customer’s own mistakes or unreasonable expectations.

Yet while the customer is not always right, it is no use to argue with him, since I have rarely seen anyone win an argument with a customer. The fact is, customers are entitled to their feelings and will act upon them, even if intellectually they are wrong. Sometimes the only course of action is to fire them.

There is nothing worse for your firm’s morale than to continue to serve customers who do not understand or appreciate the value you provide. Given a choice between continuing a relationship with a toxic customer and the effect it might have on the morale of your team members, observe who former CEO of Southwest Airlines, Herb Kelleher, sided with, as this story from Nuts! Southwest Airlines Crazy Recipe for Business and Personal Success humorously illustrates:

. . . [a] woman who frequently flew on Southwest, but was disappointed with every aspect of the company’s operation. In fact, she became known as the “Pen Pal” because after every flight she wrote in with a complaint. It was quickly becoming a volume until they bumped it up to Herb [Kelleher’s] desk, with a note: “This one’s yours.” In sixty seconds, Kelleher wrote back and said, “Dear Mrs. Crabapple, We will miss you. Love, Herb.”

And this is a company who computes that only five customers per flight account for their entire profit. So why would Kelleher so nonchalantly fire a customer? Because he stands up for his people and puts them first. Once his response was published in the Southwest newsletter, what do you think happened to team member morale?

If it comes down to a choice between your team members and an unreasonable customer, side with the team members, even at the expense of short-term profits. The team members will make up for the lost revenue, but you can hardly ever recapture the loss of dignity and respect team members suffer by forcing them to work with rude and unreasonable customers.

Even better, let your team members decide which customers to fire—you will be surprised how diligently they perform this task and then how motivated they are to make up the lost revenue.

Conclusion

It is extremely rare to be “wowed” by a service experience today, a rather sad state of affairs. Yes, it is difficult for firms to continuously raise the bar of service standards, and exceed their customer’s expectations, but most do not even appear to be trying. There are, no doubt, many reasons for this service apathy, from too much focus on what happens inside of a firm, internal initiatives more concerned with the workflow and time measures rather than the customer, to compensation structures and cultures that no longer support superior service.

If you were to examine all of the great sources of wealth creation throughout the history of the world, you would notice this profoundly important truth: In every era, the businesses that succeeded and achieved excellence took a clear stand for the customer. Indeed, the central purpose of a business is to create and serve a customer.

By providing a value guarantee, your firm will offer a superior value proposition to its customers, allowing you to charge a premium price, one commensurate with the value you are creating. A good idea whose time is now.

Other sample gurantees

Graniterock

Your satisfaction is guaranteed through our unique Short Pay Policy that states, "If you are not satisfied… don’t pay us. We will contact you immediately to resolve the problem."

Moores

Can we give you a 100% guaranteed final price?

Most of the time yes, but no-one has a crystal ball. Things change, goal posts shift. Litigation, for example, can be very unpredictable.

However, what we will do is:

explain all the possible scenarios and their likely cost

agree on a fixed price for each stage

guarantee our service

Service Guarantee - we can’t guarantee outcomes but like price, the quality of our service is another thing we can guarantee up front. If you think the quality of our service didn’t match what was agreed, let us know and tell us how you think that should be reflected in the price you pay.

Fedex

Nordstroms

Other resources

LL Bean dropping its unlimited returns policy, CNBC.com, February 9, 2018

'Loyal' LL Bean customer sues company for changing legendary returns policy, USAToday, February 14, 2018

Episode #178: Bad Medicine

For 2,400 years patients believed doctors were doing good; for 2,300 years they were wrong. Until the invention of antibiotics in the 1940s doctors, in general, did their patients more harm than good. Why do bad ideas die hard?

Ed and Ron discussed two important books that illustrate the need for us to constantly challenge our core assumptions about the way world works: Bad Medicine: Doctors Doing Harm Since Hippocrates, by David Wootton, and The Butchering Art: Joseph Lister’s Quest to Transform the Grisly World of Victorian Medicine, by Lindsey Fitzharris.

The Butchering Art

Joseph Lister, April 5, 1827 – Feb 1912 (84).

Testing ether during surgery in London, 1843, known as the “Yankee dodge” (discovered 1275!), first used in USA 1842.

One surgeon could amputate a leg in 30 seconds (once, testicles too).

Between 1843-1859, 41 medical students died from fatal infections.

Lister almost quit medicine after his brother died, and become a preacher.

The microscope played a big role in Lister’s work, but most doctors thought it was a toy.

Lister’s germ theory was rejected byThe Lancet, the leading medical journal.

He created disciples: Listerians, who saw his methods work in hospitals.

People who never doubted Lister’s work: survivors!

Doctors in the USA remain unconvinced, up until the mid-1870s. Massachussets General was the first hospital to use Lister’s methods, in 1877.

Listerine was invented and marketed by Dr. Joseph Joshua Lawrence in 1879, PA; Johnson & Johnson was also formed, first selling sterile dressings and sutures.

“New Opinions are always suspected, and usually opposed, without any other reason but because they are not already common.” - John Locke

One of Lister’s assistants said, “A new and great scientific discovery is always apt to leave in its trail many casualties among the reputations of those who have been champions of an older method. It is hard for them to forgive the man whose work has rendered their own of no account.”

“When a distinguished but elderly scientist states that something is possible, he is almost certainly right. When he states that something is impossible, he is almost certainly wrong.” –Arthur C. Clarke

Bad Medicine: Doctors Doing Harm Since Hippocrates

“We know how to write histories of discovery and progress, but not how to write histories of stasis, of delay, of digression. We know how to write about the delight of discovery, but not about attachment to the old and resistance to the new.”

Bad Medicine Drives Out Good Medicine

The history of medicine begins with Hippocrates in the fifth century BC. Yet until the invention of antibiotics in the 1940s doctors, in general, did their patients more harm than good.

In other words, for 2400 years patients believed doctors were doing good; for 2300 years they were wrong.

From the 1st century BC to the mid-nineteenth century, the major therapy was bloodletting, performed with a special knife called a lancet.

Interestingly enough, that is the title of today’s prestigious English medical journal, The Lancet. Bad ideas die hard. “The lancet was the magician’s wand of the dark ages of medicine,” according to Oliver Wendell Holmes.

Bloodletting had its opponents of course, but the debate was over where in the body to draw the blood from, not over its effectiveness.

Four treatments were used for 2,000 years: emetics, purgatives, bloodletting and cautery, ¾ remained standard therapies longer than that.

The Case Against Medicine

The author makes three devastating arguments.

First, if medicine is defined as the ability to cure diseases, then there was very little medicine before 1865. Prior to that—a period the author calls Hippocratic medicine—doctors relied on bloodletting, purges, cautery, and emetics, all totally ineffectual, if not positively deleterious (no matter how efficiently they were administered).

The term iatrogenesis describes how doctors do harm while trying to do good. It is estimated that one-third of good medicine is a placebo effect, meaning medicine up to 1865 was less effective than placebos today.

Second, effective medicine could only begin when doctors began to count and compare, such as using clinical trials.

Third, the key development that made modern medicine possible is the germ theory of disease.

This is not to say that advances in knowledge were not made prior to 1860. Unfortunately, those advances had no pay-off in terms of advances in therapy, or what Wootton calls technology—that is, therapies, treatments, and techniques to cure.

So until the 1860s, doctors had knowledge of what was wrong but could only use it to predict who would live and who would die.

Wootton describes how the advances in knowledge did not change therapies, in perhaps the most devastating conclusion in the book:

The discovery of the circulation of the blood (1628), of oxygen (1775), of the role of haemoglobin (1862) made no difference; the discoveries were adapted to the therapy [bloodletting] rather than vice versa.

...[I]f you look at therapy, not theory, then ancient medicine survive more or less intact into the middle of the nineteenth century and beyond.

Strangely, traditional medical practices—bloodletting, purging, inducing vomiting—had continued even while people’s understanding of how the body worked underwent radical alteration.

The new theories were set to work to justify old practices. [Emphasis added].

In a reversal of the scientific method, the therapies guided the theory, not the other way around.

Diffusing a new theory into a population is no easy task, nor is it quick. Wootton describes in captivating detail how various innovations in medicine were rejected by the medical establishment (the following list is much longer):

Examples of delay and resistance

Joseph Lister is credited with positing germ theory in 1865, yet there was considerable evidence for this theory dating back to 1546, and certainly by 1700. Prior to this, infections were thought to be caused by stale air and water (even Florence Nightingale believed this).

Wootton says 1865 is turning point, not transformation. 1950s medicine started extending life

Even though by 1628 it was understood that the heart pumped blood through the arteries, the use of tourniquets in amputations didn’t happen until roughly a century later.

The microscope was invented by 1677—simultaneously with the telescope, which lead to new discoveries in astronomy—yet as late as 1820 it had no place in medical research, believed to be nothing more than a toy.

Penicillin was first discovered in 1872, not 1941, as popularly believed. Its effectiveness was doubted for nearly 70 years.

The theory that bacteria, not stress, causes stomach ulcers was met with considerable resistance for over a decade. This is explained in a fascinating book The Great Ulcer War, by William S. Hughes.

Anesthesia was discovered to kill pain by 1795, first used on animals in 1824, then dentists. It wasn’t used by doctors in surgery until 1846, in London, and it was degradedly labeled the “Yankee dodge.”

Dentists pioneered anesthesia. One of first painless dentists, Horace Wells, was driven to suicide by the hostility of the medical profession.

The thermometer was invented in the 17th century, but was not commonly used until 1850 in Berlin, then New York by 1865.

The medical profession resisted the use of statistics and comparative trials for centuries. The first comparative study was conducted in 1575, but it took until 1644 for the next one. Then John Snow’s 1855 account of transmission of cholera in the water was rejected for over a decade. The modern clinical trial dates from 1946.

Puerperal fever or childbed fever caused one-half of 6 to 9 women in every 1,000 to die in the 18th and 19th centuries. In May 1847, Ignaz Semmelweis, a Hungarian doctor, advocated doctors wash their hand in between patient—and cadaver— examinations. The incidence of fever fell dramatically, but he didn’t publish his findings until 1860, which by that time he was considered an eccentric, being confined to a lunatic asylum in 1865; two weeks later he died. (Interestingly, even he still believed the disease was caused by stale air).

Why the delay?

Wootton believes the primary obstacle to progress was not practical, nor theoretical, but psychological and cultural—“it lay in doctor’s sense of themselves.” Consider the psychological obstacles:

Medicine has often involved doing things to other people that you normally should not do. Think for a moment what surgery was like before the invention of anesthesia in 1842.

Imagine amputating the limb of a patient who is screaming and struggling. Imagine training yourself to be indifferent to the patient’s suffering, to be deaf to their screams. Imagine developing the strength to pin down the patient’s thrashing body.

Imagine taking pride, above all, in the speed with which you wield the knife, in never having to pause for thought or breath: speed was essential, for the shock of an operation could itself be a major factor in bringing about the patient’s death.

To think about progress, you must first understand what stands in the way of progress—in this case, the surgeon’s pride in his work, his professional training, his expertise, his sense of who he is.

The cultural obstacles, Wootton believes, are based on a somewhat counterintuitive observation: institutions have a life of their own.

All actions cannot be said to be performed by individuals; some are performed by institutions. For instance, a committee may reach a decision that was nobody’s first choice.

This is especially true for institutions that are shielded from competition and hermetically sealed in orthodoxy.

In a competitive market, germ theory would have been tested in a competing company, diffusing into the population much faster than it did within the institutions of the medical community.

Germ theory was adopted because the medical profession knew it was in crisis.

Why is this Relevant to the Professions?

The similarities between bad medicine, the billable hour, timesheets, Frederick Taylor’s efficiency metrics, and value pricing are illustrative. Even today the US Centers of Disease Control reports that 2 million people get infections in hospitals, of those 90,000 die. The largest cause? Failure to properly wash hands.

In physics the key barriers to progress are most likely theoretical. In oceanography they might be practical. What are the key barriers to progress in the professional knowledge firm?

My VeraSage colleague Tim Williams remarked on Wootton’s book: “It makes me think about Stephen Covey’s premise [in his book, The Seven Habits of Highly Effective People] that if you want to make incremental changes, work on practices. If you want to make significant changes, work on paradigms.”

The problem is, minds are slower to change than markets, especially in the professions.

If a supposed scientific and evidence-based profession is this slow to change, what chance do lawyers, CPAs, and other professionals have to move away from the discredited labor theory of value—the modern-day equivalent of bloodletting?

Will the professions resist change for as long as doctors did? Are the cultural and institutional legacies that entrenched? Do professionals really want to define themselves by how many hours they log on a timesheet?

We do not know, but the evidence seems to indicate in the positive. Obviously, burying the billable hour and the timesheet is going to be a very long process indeed. It may not be within reach, but it is certainly within sight.

Other Reading

Ron’s article in the CPA Practice Advisor, “The Diffusion of Value Pricing in the Profession.”

Episode #177: Interview with Barry Melancon

Barry C. Melancon is the President American Institute of CPAs and CEO, Association of International Certified Professional Accountants, the most influential body of professional accountants in the world with 650,000 members and students.

Formed in 2017, it combines the strengths of The Chartered Institute of Management Accountants (CIMA) and the American Institute of CPAs (AICPA), which Melancon also leads as President & CEO.

Barry joined the AICPA in 1995 when he was 37 years old, and is now the longest serving CEO in the organization’s 129 year history.

Under his tenure, the AICPA has grown to become the largest membership body of CPAs in the world and has spearheaded a number of initiatives to benefit not only the profession, but also investors, business owners, lenders and the general public.

These include audit quality centers; private company reporting standards; eXtensible Business Reporting Language (XBRL); the computerized CPA exam; and two consumer financial literacy education programs.

Topics we discussed with Barry

Take us from a small CPA firm in Louisiana to president of the AICPA—did you aspire to be head of the AICPA?

What’s your “Why”—what motivates you, why do you do what you do?

Enron, etc., was a rough couple of years, but you and the profession persevered, and even grew stronger—is that how you assess it as well?

Actual ad from 2002. Happily the AICPA and the accounting profession have emerged stronger than ever.

What do you think about Sarbanes-Oxley, has it helped or hurt?

What’s the one issue in the profession that keeps you up at night?

How do you see all this new technology—blockchain, AI, etc.—do you see them displacing, or complements, or substitutes, to existing CPAs?

You don’t have a dystopian view of all this technology; you sound more optimistic about it?

According to Tim Harford’s book, Fifty Inventions That Shaped the Modern Economy, the language of accountancy is an oral tradition. We are getting back to that, those with excellent auditory skills will flourish.

Wouldn’t be a VeraSage interview if we didn’t discuss timesheets. Is the AICPA looking at changing its peer review standards on timesheets for firms that are moving away from using them?

The challenges of security with the online CPA exam?

Demography is destiny. What are the demographics of the profession?

What advice would you give to a small CPA firm owner?

What one thing would you want someone like me to say to an accounting high school class?

Related Interview

Our interview with the AICPA’s Mark Koziel, Episode #75, from January 15, 2016.

Episode #176: Free-rider Friday - January 2018

Ron’s Topics

“This Fancy Restaurant Just Introduced Surge Pricing,” Money, January 11, 2018, Richard Vines/Bloomberg

One of London’s leading restaurants: Bob Bob Ricard, where each table has a call-button for Champagne, has introduced surge pricing. The same menu will now offer:

25% lower prices during off-peak times (Monday Lunch)

15% off mid-peak (Tues/Sun dinner)

Sat dinner is full price

The Fairness effect is being handled well: It is not changing the menu, it’s just establishing that certain days will cost less, thereby offering a discount off standard rather than a surcharge for peak times.

We wonder if same size parties will end up spending more at off-peak times, given this discount?

The surge pricing does not apply to wine and champagne.

“Not great, again,” The Economist, January 6, 2018

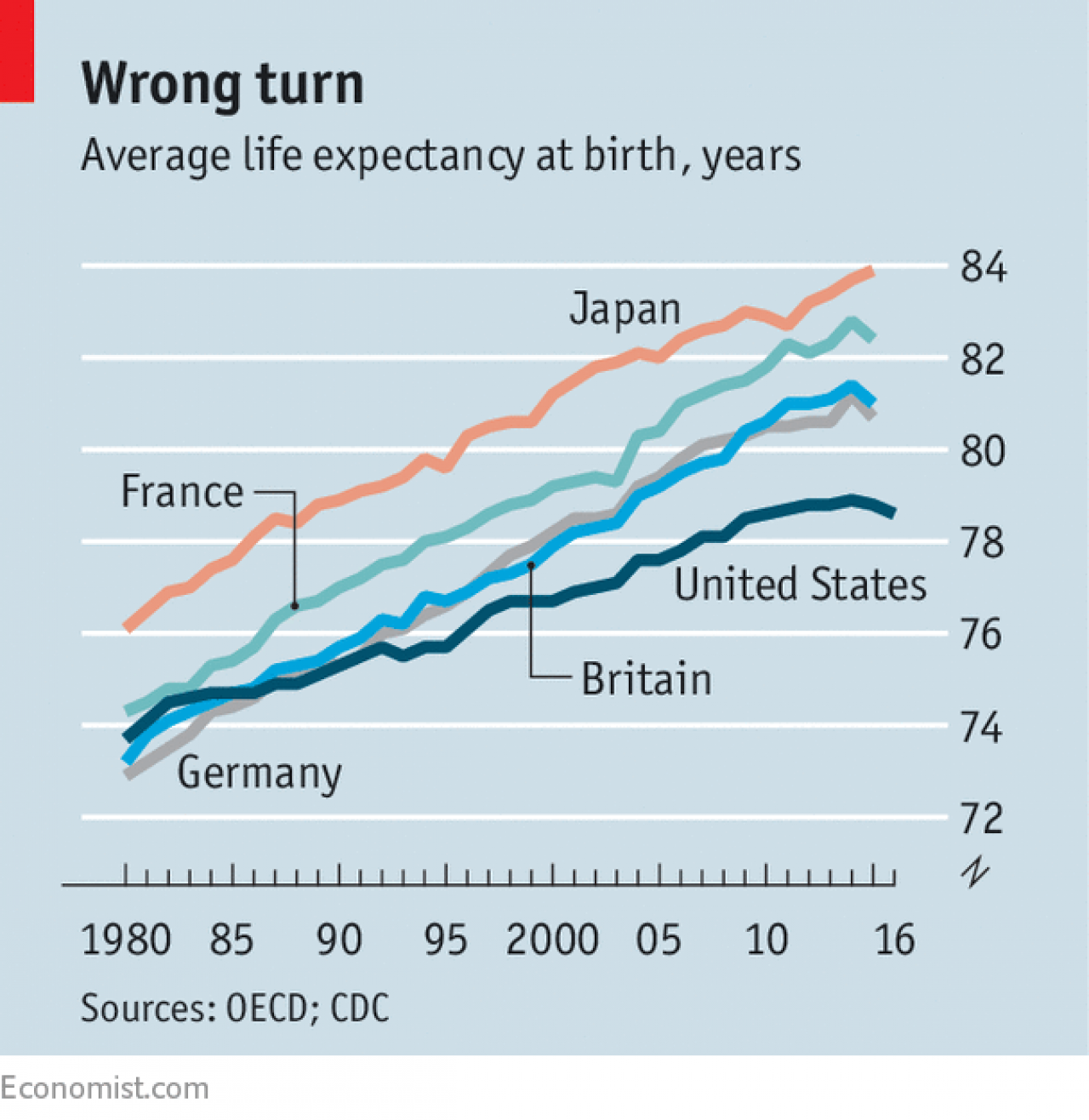

According to a Center for Disease Control report dated December 21, 2017, life expectancy in the USA fell in 2016 for the second year in a row. The last time this happened was 1962-63. For a three year decline, you have to go back to the Spanish flu pandemic a century ago.

Life expectancy is now 78.6 years, down from 78.9 in 2014 (two years lower than the average in OECD countries), and 78.7 in 2015.

One cause is the epidemic of addiction to opioids, which claimed 63,000 lives in 2016.

The leading cause of death remain heart disease and cancer, which have leveled off, and even declined a little.

The category known as “unintentional injuries”, which includes overdoses, has moved from third to fourth place from 2015. Six percent of deaths in 2016 were individuals in the prime of their lives, ages 25-34.

Preliminary data for 2017 indicate these deaths will continue to rise.

The Economist then blames president Trump for not appointing a drug tsar appointed, and not spending more money.

Good news: the number of deaths in 2017 on regularly scheduled passenger jets: 0, a decline from 2,429 in 1972 and 761 in 2014.

“Look, Ma, No Driver,” CSAA

Last November, CSAA and Keolis launched a level 4 autonomous minibus in Las Vegas that navigates a three-block circuit in a downtown neighborhood.

“Home runs,” The Economist, December 23, 2017: Parcels are delivered an average of 1.5 times in the Nordic region due to worries over “porch-piracy.” Forty percent avoid online purchases.

Now, wirelessly connected locks, security cameras, and an App ($199) allow delivery people to enter residences to drop off packages.

Amazon is testing this system in 37 American cities, WalMart also, and even Sears for appliance repairs.

“Beyond bitcoin,” The Economist, January 13, 2018

Dogecoin was launched in 2013 as a joke, and as of January 7 had $2 billion in circulation. Others, such as UFOcoin, Putincoin, Sexcoin, Insanecoin ($7m) have also been launched.

Around 40 coins have a market value exceeding $1 billion.

On January 9th Kodak launched a coin that allows photographers to charge for their work.

Telegram, a messaging service with 180 million users, will launch Gram to pay for range of services from online storage to virtual private networks.

Reportedly, Facebook is looking into creating a digital coin. Would Bitcoin’s days be numbered?

“Taming the titans,” The Economist, January 20, 2018

Google, Facebook, Amazon, Apple are all BAAD: Too big, anti-competitive, addictive, destructive to democracy.

Anti-competitive - Facebook and Google control 80% of news referral traffic; Google has an 80% market share in search, while Amazon controls 40% of online commerce. They all have a huge advantage due to network effects.

Addictive - Teens who use social media extensively are less happy than peers. Depression and suicides have risen. Apple CEO Tim Cook told his nephew to lay off social media.

Damaging democracy - People now get their news in filter bubbles, strengthening confirmation bias, and fake news is on the rise.

Proposed actions - “Hipster antitrust.”

Break them up!

Utility regulation - Mark Zuckerberg, you’ll rue the day you referred to Facebook as a utility, as ubiquitous as electricity. It’s hard to regulate prices when they are $0, so more likely regulators would cap profits.

Prevent new acquisitions

Data portability and interoperability. Customer data binds users to you and data gives them a huge competitive advantage. Let customers move their data elsewhere, and force companies to share the data with other firms.

Like sexual harassment scandals, M for monopolist, is today’s scarlet letter.

Content liability—your blanket protection won’t last. Germany can now impose fines if extremist content is not taken down within 24 hours.

Ed’s Topics

Alexander C.R. Hammond, “The Ice Box Cometh”

In 1919, a refrigerator cost $11,000 in today's money

Tasks that needed servants or, later on, expensive equipment, are now cheap for all

Most people have a cheap fridge three times the size of the earliest models

“Stop Calling it an Opioid Crisis,” CATO, January 9, 2018

The "crisis" talk is cause some people in very serious pain to avoid any and all opioids for fear of getting addicted. While that is possible, proper usage makes it unlikely.

The Greatest Showman movie, on P.T. Barnum

Ed gives it a thumbs up and recommends people see it and look for the entrepreneurial angle.

See TSOE Episode #55 where we profiled P.T. Barnum

“Paying More at the Pump Will Not Fix California’s Roads if Politicians Keep Raiding the Gas-Tax Fund,” William F. Shugart II, Kristian Fors, January 5, 2018, Independent Institute

By July, Californians will be paying 65.7 cents per gallon in tax alone. Worse still the money, which is supposed to go to fix the roads, isn't.

Tax reform has done what the $15 minimum wage could not. See our TSOE Episode #88: Do Corporations Pay Taxes?

Partial list of companies raising the base wage to $15 per hour are:

American Savings Bank, 1,100 employees

Americollect, 250 employees

Aquesta Financial Holdings, 95 employees

Associated Bank

Bank of Hawaii, 2,074 employees

Bank of James

Bank of the Ozarks, 2,300 employees

Central Pacific Bank, 850 employees

Comerica Bank, 4,500 “non-officer” employees

First Hawaiian Bank, 2,264 employees

HarborOne Bank, 600 employees

INB Bank, 200 employees

Regions Financial Corp.

SunTrust Banks, 24,000 employees

Territorial Savings Bank, 247 employees

Episode #175: The Laws of Systems Thinking

In this show, we discuss the 11 Laws of Systems Thinking as laid out in the book: The Fifth Discipline: The Art & Practice of The Learning Organization, Peter M. Senge, 1990.

Episode #174: Best Business Books for 2017

“I think we ought to read only the kind of books that wound and stab us. If the book we are reading doesn’t wake us up with a blow on the head, what are we reading it for.” --Franz Kafka

Ron and Ed’s Best Business Books Read in 2017

Deep Thinking: Where Machine Intelligence Ends and Human Creativity Begins, Garry Kasparov

“Deep Blue was intelligent the way your programmable alarm clock is intelligent. Not that losing to a $10 million alarm clock made me feel any better.”

“It was a human achievement, after all, so while a human lost the match, humans also won.”

“Being remembered as the first world champion to lose a match to a computer cannot be worse than being remembered as the first world champion to run away from a computer.”

The Grid: The Decision-Making Tool for Every Business (Including Yours), Matt Watkinson

“Essentially, all models are wrong, but some are useful.” --George E. P. Box, mathematician

A good model that illustrates that organizations are interdependent, and you can’t change or optimize one aspect of a firm without changing—sometimes for the worse—other areas.

Fifty Inventions That Shaped the Modern Economy, Tim Harford

"The Luddites didn’t smash machine looms because they wrongly feared that machines would make England poorer. They smashed the looms because they rightly feared that machines would make them poorer."

The Gramophone

"The top 1 percent of musical artists take more than five times more money from concerts than the bottom 95 percent put together."

The Welfare State (and passports)

"These two massive government endeavors—the welfare state and passport control—go hand in hand, but often in a clunky way. We need to design our welfare states to fit snugly with our border controls, but we usually don’t. "

Passports were designed more to keep people IN by not allowing them out!

The Dynamo

"Until around 1910, plenty of entrepreneurs looked at the old steam-engine system, and the new electrical drive system, and opted for good old-fashioned steam. Why? The answer was that to take advantage of electricity, factory owners had to think in a very different way."

"What explained the difference? Why did computers help some companies but not others? It was a puzzle. Brynjolfsson and Hitt revealed their solution: What mattered, they argued, was whether the companies had also been willing to reorganize as they installed the new computers, taking advantage of their potential."

Double Entry Bookkeeping

"Someone would be charged to take care of a particular part of the estate and would give a verbal “account” of how things were going and what expenses had been incurred. This account would be heard by witnesses—the “auditors,” literally “those who hear.” In English the very language of accountancy harks back to a purely oral tradition.

So what, a century later, did the much-lauded Luca Pacioli add to the discipline of bookkeeping? Quite simply, in 1494, he wrote the book.10 And what a book it was: Summa de arithmetica, geometria, proportioni et proportionalita was an enormous survey of everything that was known about mathematics—615 large and densely typeset pages. Amid this colossal textbook, Pacioli included twenty-seven pages that are regarded by many as the most influential work in the history of capitalism. It was the first description of double-entry bookkeeping to be set out clearly, in detail, and with plenty of examples."

Microslices: The Death Of Consulting And What It Means For Executives, John M. Dillard

John M. Dillard started his career at the Central Intelligence Agency (CIA) and has dedicated every working hour since to helping organizations, private and public, uncover secrets to stay ahead of future threats— whether those threats are competitive, operational, or security related. His 15-year career in management consulting has benefited everyone from large players such as Deloitte Consulting to smaller companies such as the one he cofounded, Big Sky Associates. His consulting experience runs the gamut: from commercial strategy to government security operations and large scale IT, from banking administrative flows to analyzing operations at the 9/ 11 recovery site at New York City’s Ground Zero.

Huge proponent if value-led pricing. Mentions Alan Weiss.

Mentions “knowledge workers” ten times!

Ed started creating a list of sentences that could have been written by Ron Baker, but I stopped after I the first dozen of so.

The new model is a shift away from David Maister’s Trusted Advisor model.

Microslices Defined: The accelerating specialization, compression, and automation of consulting activities. Fully realized it will be the dominant business model of professional services.

Makes major points about big data and data science:

Collecting lots of data is mostly useless without the ability to design techniques, predictive analytics, machine learning tools, and visualization techniques that provide insight into what it means.

Data science and technology are not the same thing. Technology enables advanced data science, but data science is not hardware. In some cases, data science is enabled by software, but data science will not be performed by the IT guy in your company.

Data scientists are not another flavor of computer scientist or technology consultant.

Data science is just as concerned with masterful inquiry as it is with technical mastery. The art of asking incredible questions, testing hypotheses, validating results, and using the scientific method is at the heart of data science.

Data science is more about creating the right questions to ask the data than about the technology of how to access the data.

Why is it important:

First, data science facilitates faster delivery of professional services.

Second, data science allows deeper specialization of professional service providers.

Finally, data science is going to provide the basis for the automation of consulting tasks.

From Dillard's Company Manefesto

Time and value are not equivalent. We will provide maximum value in as little time as possible. The old model of charging on the basis of time is broken. We will never take longer than necessary to deliver a result.

Work is something you do, not a place you go. Our work culture rejects “presentee-ism” (a belief system based on people being physically present) in favor of presenting killer results.

Do unto ourselves as we would have our clients do unto us. Big Sky’s relationship with its employees should mirror our relationship with our clients. In other words, we expect our clients to respect us and focus on results, so we should do the same to each other.

Greatness isn’t for everyone. Some executives really want to pay to see someone sitting in a cube at their facility, no matter how good or bad the work is. Some executives really want to pay to direct the details of how the work is done instead of for a specific result, which requires them to be charged by the hour. We believe that we should prove that our way is better—but that requires clients who accept proof.

Other good ideas:

"Professional services executives, like executives in previously disrupted industries, make claims that they are “different,” that their model is based on trust, or that their hundred-year-old brand is impregnable. In law, consulting, accounting, and similar businesses that have traditionally been dominated by brand and reputation, executives may claim that too many functions could never be commoditized. They are wrong."

Every company is becoming a tech company; some just haven’t realized it yet.