Life is not worth living if we exercise our profession only for the sake of material success and do not find in our calling an inner necessity and a meaning which transcends the mere earning of money, a meaning which gives our life dignity and strength. –Michael Novak

We must hold a man amenable to reason for the choice of his daily craft or profession. It is not an excuse any longer for his deeds that they are the custom of his trade. What business has he with an evil trade? Has he not a calling in his character? –Ralph Waldo Emerson

The term profession comes from the Latin noun professio, which is derived from the past participle professus, or the verb profiteri, denoting “to declare publicly, own freely, acknowledge, avow.” Professionals are said to “profess” something, they stand for something. The noun professional didn’t appear in American dictionaries until 1861.

In the 18th and 19th centuries “professions” referred to theology, law, medicine, and education. From the early 17th till the mid-18th century, theology was considered the preeminent profession. Sociologist Bruce Kimball, in his book The “True Professional Ideal” in America, suggests three eras of professionals: religion through the mid-18th century; polity (law) through the mid-19th century; and science through the 1910s. It took until 1925 until the first public opinion survey of vocational status showed that doctors had passed lawyers and ministers (though not professors) in public esteem.

It’s interesting to note that a trip to the doctor didn’t do much good until the 1920s or 1930s with the introduction of antibiotics. Before then, most visits were ineffective and a large number were downright harmful. The Hippocratic principle of primum non nocere (“first, do no harm”) continues to be an essential guideline for all professional conduct.

Scholars have traced regulation of the professions to ancient Babylon and the Code of Hammurabi. Written about 1800 B.C., the Code set predetermined fees for surgeon’s services and imposed penalties for malpractice (including the severing of a surgeon’s hand if the patient died from an operation). The first law to regulate a profession in America was in 1639 in Virginia, where the purpose was to control fees physicians could charge. Ten years later, Massachusetts passed a law regulating the quality of medical care. Under the U.S. Constitution both professional licensing and education are “residual powers” and deemed state prerogatives, which is why occupational licensing is under the jurisdiction of the states.

The Characteristics of a Profession

According to Kimball:

By the beginning of the twentieth century, the term [profession] denoted a dignified vocation with three fundamental characteristics. One topic concerns the body of functional knowledge, or expertise, associated with a profession and involves issues of epistemology, utility, and education. A second topic concerns the profession’s organization into an association and involves such issues as autonomy, exclusion, licensing, and certification. The third fundamental topic is the ethic of professional service.

Needless to say, these three basic topics––expertise, association, service––have often been subdivided by scholars into lists of six, eight, ten, or more characteristics. But such characteristics are often redundant or may easily be aggregated on grounds of parsimony. Meanwhile a good deal of testimony affirms that “there are three ideas involved in a profession: organization, learning...and a spirit of public service.” ...the “collegial, cognitive, and moral,” that is, “autonomy, service, and knowledge”––are characteristics of the “ideal” of a profession (Kimball, 1995: 323-24).

Let us explore these three characteristics as they relate to the CPA profession.

Expertise

Because professionals possess a specific body of knowledge, obtained through education and on-the-job training, the belief is only those with this knowledge are able to regulate the activity. Also, professionals provide advice and intangible knowledge––as opposed to offering tangible goods––and therefore the technical competence and quality of those offering this advice need to be ensured in order to protect the public.

CPAs obtain this specialized knowledge through formal education in college, and demonstrate their competence by passing the Uniform CPA Examination, and also by on-the-job training and continuing professional education.

It is interesting to note that in June 1898, Christine Ross (a native of Nova Scotia) passed New York CPA exam, but certificate No. 143 was withheld till December 21, 1899, after the Board of Regents decided whether or not a woman should be certified. What this delay had to do with her technical competence and expertise is an interesting question.

Autonomy and Exclusion

Autonomy is from the Greek words for “self governance.” One of the hallmarks of a profession is its ability to self-regulate itself. Because information in professional markets is asymmetrically distributed––that is, sellers know more about the quality of the services rendered than do the consumers––this further enforces the need for professionals to regulate who may enter, and continue to remain, in the profession.

The CPA profession––through the voluntary association of the AICPA, various state societies and the state board of accountancies––engages in self-regulation by: administering the Uniform CPA Examination process and the requirements necessary to qualify for it; granting and administering licenses to practice; promulgating a Code of Professional Conduct; requiring peer review of firms providing attest services; enforcing continuing professional education requirements; carrying out disciplinary actions against members of the profession who violate the Code or laws, or engage in acts discreditable to the profession.

Exclusion––or monopoly status––is granted to the profession through licensing and certification requirements. Society grants monopoly status to a profession in order to protect the public from unlicensed practitioners. The only monopoly status the CPA profession possesses is in the attest function. One must be a CPA in order to render an opinion on a financial statement. The other services CPAs provide––from tax services to management advisory services––are not covered by this monopoly status. Approximately 15% of the CPA profession is engaged in auditing activity, which is why many states have now developed separate avenues to get certified without providing audits.

Monopoly status is not a right of a profession, it is a privilege granted by the state. Theoretically, if society believes the profession is not properly servicing it, monopoly status can be revoked. Also, increased regulation and legal liability are other methods that can be used to ensure a profession is fulfilling its obligations to society. Expansion of legal liability of CPAs and recent legislation such as the Sarbanes-Oxley Act of 2002 is a manifestation of this reality.

It should also be noted that most economists are against monopoly status being granted to any professional, because it reduces innovation, raises prices to consumers, and hinders the dynamism of a free market. The deregulation of the professions that has occurred over the past few decades reflects this view.

The Spirit of Service

Two Latin phrases sum up the ethic of service that is another core value of a profession: Non sibi sed allis, “Not for ourselves but for others” and Pro bono publico, “For the public good.” Because society grants professions monopoly status, it expects members of that profession to put the interests of the public ahead of its own member’s interests.

In fact, the AICPA Code was modified January 12, 1988 and a public interest principle was added, which states that conflicts are to be resolved in favor of the public. Even in the absence of codes and principles promulgated by a professional body, individual members and firms have been known to hold themselves to higher standards.

For instance, George May, a British Chartered Accountant born in 1875, and a senior partner at Price Waterhouse, insisted on financial independence from clients thirty years before the idea occurred to accounting’s professional bodies.

Prior to 1978, some legal and accounting professional ethical codes placed limits on advertising, and soliciting clients––known as afferent ethics, since they deal with relationships among professionals. But since these regulations affect the public, they can also be thought of as efferent ethics, which deal with how the profession shall act in the public interest.

An example of this is the famous 1977 Supreme Court Case Bates & O’Steen v. State Board of Arizona, 433 US 350 (1977), wherein the Court ruled that attorneys could market their legal services. Prior to this landmark case, the AICPA Code of Professional Conduct explicitly proscribed advertising, stating:

Solicitation to obtain clients is prohibited under the Rules of Conduct because it tends to lessen the professional independence towards clients which is essential to the best interests of the public. ...Advertising which is a form of solicitation is prohibited...Promotional practices such as solicitation and advertising, tend to indicate a dominant interest in profit.

Infamous “Bates” Ad

Th ad that started the controversy. It went all the way to the Supreme Court of the United States.

In 1978, the CPA profession responded to the Bates decision by amending this rule to read, "A member shall not seek to obtain clients by advertising or other forms of solicitation in a manner that is false, misleading, or deceptive."

Many economists have argued that advertising has had a salutary effect on professional services by providing more information to consumers, more competition, more choices, new innovative services, better client service, and lower prices. Some members of the profession dispute this and have a tendency to look upon this deregulation as one of the problems causing the alleged compromises to auditor independence, which may have contributed to the recent accounting scandals.

The True Professional

A professional is someone who is responsible for achieving a result rather than performing a task ––Michael Hammer

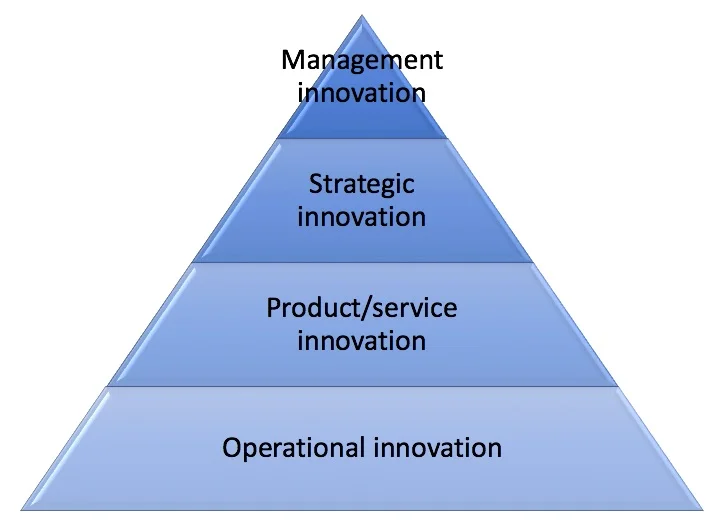

In The Experience Economy, Joseph Pine and James Gilmore posit a progression of economic value. We believe professionals are poised at the top of their curve: transformations:

If you charge for stuff, you are in the commodity business (fungible)

If you charge for tangible things, you are in the goods business (tangible)

If you charge for the activities you execute, you are in the service business (intangible)

If you charge for the time customers spend with you, you are in the experience business (memorable)

If you charge for outcomes the customer achieves, then you are in the transformation business (effectual—the customer is the product)

Listen to our interview with Joseph Pine from March 6, 2015.